82% of Businesses that fail do because of cash flow problems. – U.S. Bank study

56% of small business owners hate financial tasks. – Infusionsoft surveys

Ok, this is so stupidly obvious to me. Hating your financials will make you so much more likely to have cash flow issues.

Unfortunately telling you this doesn’t suddenly make you love your financials, does it? I’m not that optimistic about my ability to convert you into financial nerds so quickly. That’s why we’re here to simplify the problem and provide a streamlined solution. We’re here to reduce your pain and help you make better decisions in the process.

You Might Not Have to be Perfect to be Okay

The completely correct way to ensure you can manage your cash flow is to do a full-blown cash flow forecast on a monthly basis. That can be a lot of grueling work. It sounds exciting to me! But, from the looks of things, at least 56% of you would want to put me in a rubber room for thinking this stuff could be fun.

So let’s make a deal. I’ll give you some indicators that help you decide if your cash flow situation needs more scrutiny. And then I can have the joy of doing some of this math for you even if I don’t get to see your actual financials.

The Subtle Difference Between Cash Flow and Profits

Cash Flow is not the same as profitability. Profitability is its own issue that is often bucketed in with cash flow. These KPIs are not looking at profitability but might catch a profitability issue even though they’re not specifically looking at it.

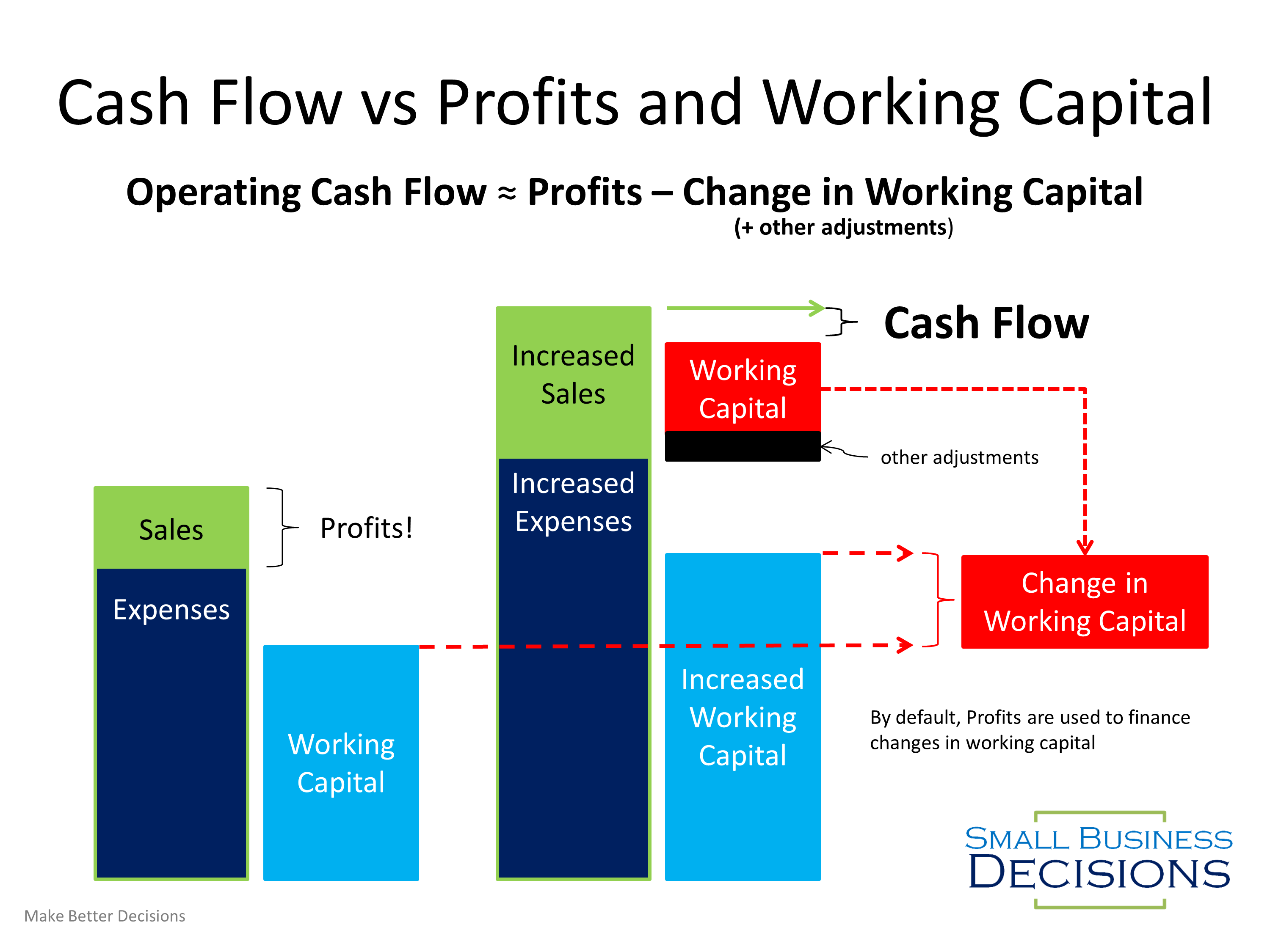

When you grow quickly, your cash flow might be lower than if you grow slowly. This difference is counter-intuitive and can be a source of lots of confusion. The primary reason for cash not following profit is because most of your profits might be tied up in working capital for the next job before the last job is paid for. Figure 1 attempts to simplify and illustrate this concept.

The top 3 KPIs for Cash Flow Management

I’ve sorted through nearly 100 financial ratios to find the best three that are going to be an indicator of your cash flow health on a Monthly basis. They’re not as telling as a full-blown cash flow forecast would be, but it’s a step in the right direction. It depends on how your business is doing. If your cash is tight, then getting more accurate is more important.

1. Cash Conversion Cycle

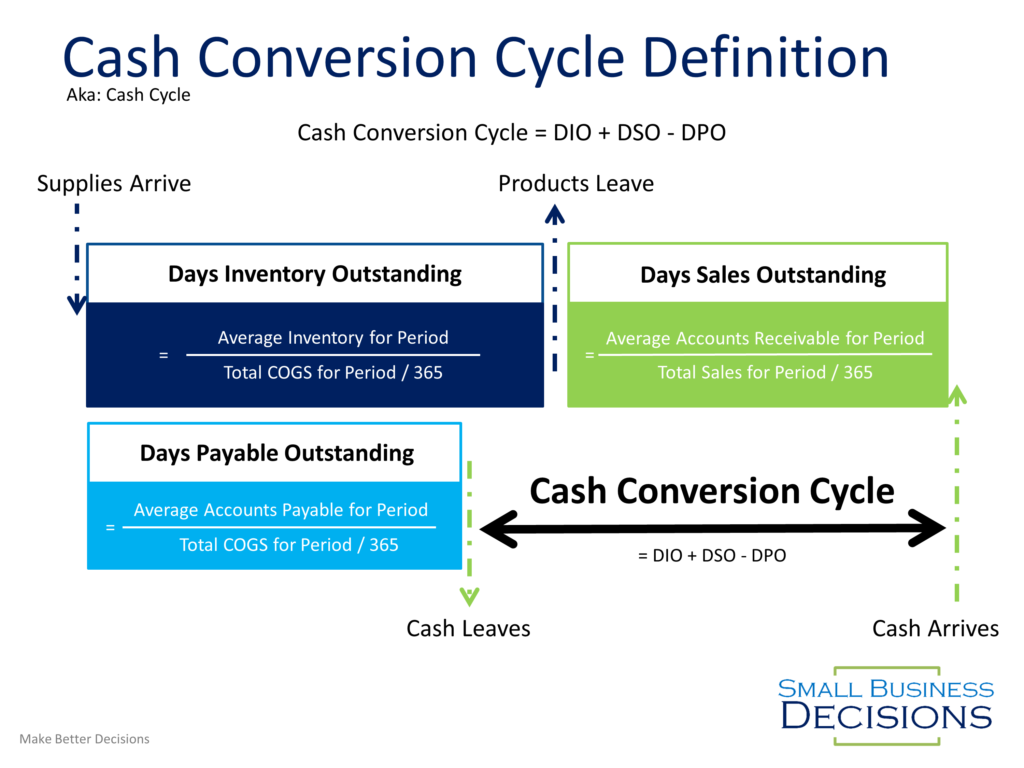

The Cash Conversion Cycle (aka, Cash Cycle) indicates the amount of time between spending cash and receiving cash for each sale. It considers how Inventory, Accounts Receivable and Accounts Payable impact your overall cash position by indicating how long cash is tied up in your business process as working capital. The longer your cash conversion cycle is, the more you will need to pay close attention to how much cash is tied up in working capital.

Notice the difference between when your supplies arrive and your products leave in Figure 2. That is what your P&L pays attention to: the value you create. But notice that your cash is on a different timeframe. That right there, is why there is a separate Cash Flow focus. This ratio should stay relatively constant with growth in sales, and a low or negative number has been shown to indicate excellent growth potential.

2. Sustainable Growth Rate

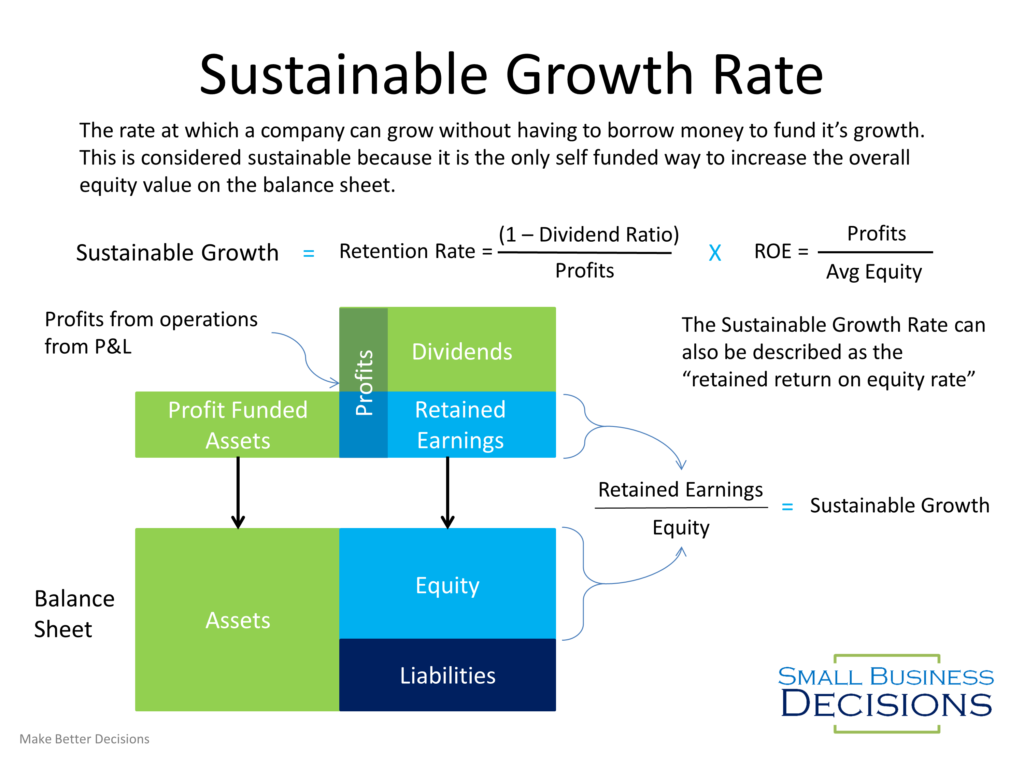

The Sustainable Growth Rate determines what percentage of growth can be financed by earnings without having to finance it’s working capital. Without financing through loans or sale of shares, any increase in assets has to come from retained earnings. This number isn’t exact, but it’s a good indicator of the realistic maximum rate that you can grow your sales without needing outside financing. This number is critical because if you are planning on growth near or beyond this rate you will need to consider a largely different strategy for financing or operations.

Remember that return on equity is = Net Income / (Assets – Liabilities) where assets include inventory and accounts receivables and liabilities include accounts payable. Thinking of it this way after we learned about the Cash Conversion Cycle shows how Return on Equity is drawing a relationship between income and the process of converting sales into cash. Shortening your Cash Conversion Cycle will increase your Sustainable Growth Rate.

3. Quick Ratio (Acid Test Ratio)

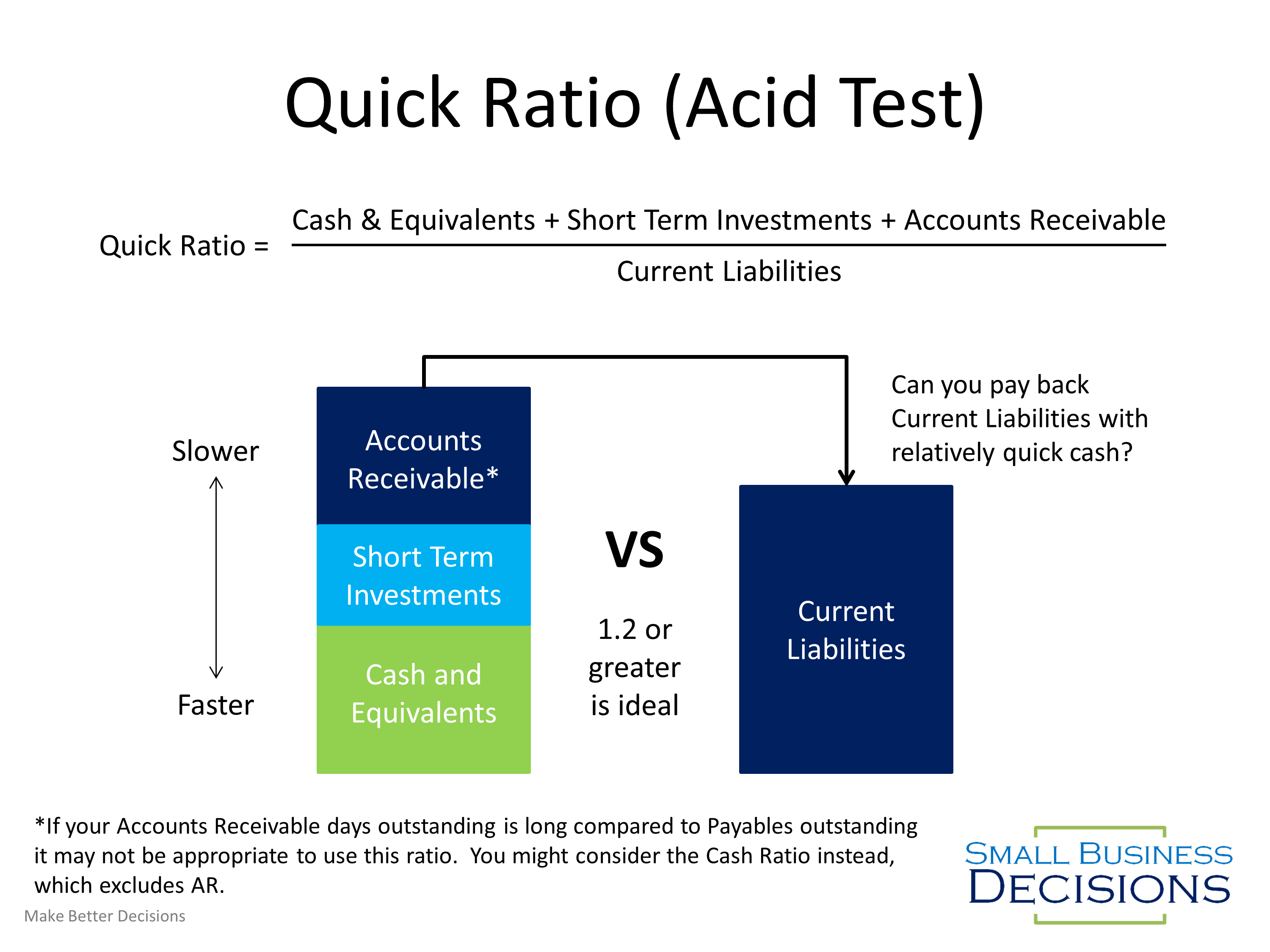

The Quick Ratio shows whether a business has the ability to pay off current liabilities with quickly available cash. This ratio excludes inventory from the current assets because it usually takes time to convert inventory into cash and you never want to end up in a situation where you are selling inventory instead of converting it to products.

This ratio should be between 1.2 and 2. If your business has Days Receivables Outstanding that are significantly longer than Days Payable Outstanding then you are probably better off using a higher target or switching to the Cash Ratio. The Cash Ratio is the same as the Quick Ratio but excludes Accounts Receivable.

Downloadable Calculator

An excel sheet which calculates these three KPIs based on your last two years P&L and Balance Sheet data is available to download for subscribers below.

Most Important Cash Flow KPIs Calculator DownloadDecide:

Decide to follow these KPI trends on a Monthly basis for your business. If you see wayward trends you can make changes before the problem gets more serious. Luckily, since there’s only three of them, you won’t have to spend too much time on it. If you don’t enjoy financials, the put these into a pretty chart and watch how the picture changes instead of being bored with the numbers.

Hello.This article was really motivating, particularly since I was investigating for thoughts on this matter last week.